The Class You Never Took: What 16,000 Hours of School Forgot to Teach

By the time most students graduate high school, they’ve sat through over 16,000 hours of classes.

They’ve solved for x, written essays on Shakespeare, memorized the periodic table, and learned about the Civil War—often more than once. But ask them how a credit card works, what a budget looks like, or how to start saving for retirement, and most will probably get a blank stare.

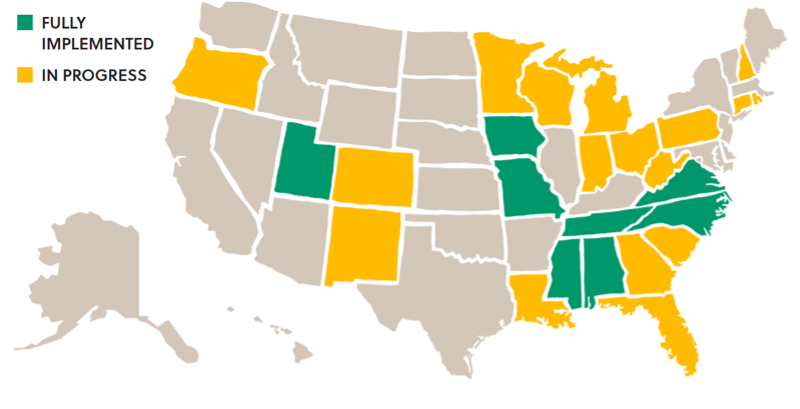

A study by TIAA found that Gen Z could correctly answer only 43% of financial literacy questions—the lowest of any generation surveyed. (Source: TIAA Institute-GFLEC Personal Finance Index). Perhaps this is because only 28 out of 50 states either require high schoolers to take a personal finance course to graduate or are in the process of doing so! Along the way, most young people absorb financial habits from their parents and inherit a growing national crisis: financial illiteracy.

The Price of Illiteracy

And the cost of that crisis is steep:

- $105,000 is the average debt American households carry. (Source: Experian, “Average U.S. Consumer Debt and Statistics,” 2025). This includes everything from student loans and credit cards to mortgages and personal loans—debt that many people don’t fully understand how to manage or pay off effectively.

- 78% of people live paycheck to paycheck. (Forbes, “Living Paycheck to Paycheck Statistics,” 2024). That means the majority of Americans are just one unexpected expense or missed paycheck away from financial crisis.

- 40% of Americans couldn’t cover a $400 emergency expense without borrowing money or going deeper into debt. (Source: Fortune, “ ‘Turbulence Ahead’: Nearly 4 in 10 Americans lack enough money to cover a $400 emergency expense, Fed survey shows,” 2023). This statistic highlights a widespread lack of savings and preparedness for the unexpected.

Many dream of financial independence, but for too many, it feels like just that—a dream. Once considered the “land of the free,” our educational landscape has left many feeling robbed of the life they once envisioned. The truth is, not understanding how money works means that your future can be stolen by those who do—those who understand interest rates and wield the power of financial systems. These are the credit card companies, the loan sharks, the “Buy Now, Pay Later” campaigners, and even the government. They are the American Dream thieves.

The Great Equalizer

“Education is the most powerful weapon which you can use to change the world.” — Nelson Mandela

However, education is the Great Equalizer — it’s the bridge between where we are and where we want to be. The abolitionist Frederick Douglass, who taught himself to read as an enslaved child, famously said, “Once you learn how to read, you will be forever free.” The same principle applies to financial literacy. Financial education is the first of the 7 Money Milestones, a roadmap that helps you close the gap between your current reality and your future goals. It equips you with the power to ask questions most people never think to ask, like:

- Am I building wealth—or just paying bills?

- What’s my real cost of borrowing—not just the monthly payment?

- Where should I keep my emergency fund so it’s safe but still growing?

- How can I create generational wealth that lasts beyond me?

Be The Change

“Someone is sitting in the shade today because someone planted a tree a long time ago.” — Warren Buffett

Learning how money works is about far more than just understanding numbers and interest rates. It’s about equipping ourselves—and those we care about—with the tools to navigate life’s challenges, pursue opportunity, and make confident, informed decisions. When financial education becomes widespread, we begin to shift what’s possible. We create a society where opportunities aren’t limited by zip code, inheritance, or background.

Instead, people gain the ability to break free from the cycles of missed chances and spiraling debt— and start building something lasting. The rules of the game are written by those who understand how to play. Committing to financial literacy is like planting a seed that won’t blossom overnight—but with time, grows into something rooted and strong. It’s an investment not just in yourself, but in everyone who will one day benefit from your knowledge—family, friends, and future generations who may one day stand in the shade of your oak of financial freedom.

Take The Next Step

Begin your journey today by downloading your free copy of Change Your Literacy, Change Your Life. Inside, you'll find real stories of people who transformed their legacy by learning how money really works—and how you can do the same. Then take the Financial Literacy Quiz to see where you stand. You’ll get a personalized report showing where your financial knowledge is strong—and where you can grow. Finally, schedule a time with me to turn those insights into action. Together, we’ll create a strategy tailored to your goals—so your money works for you, not the other way around.